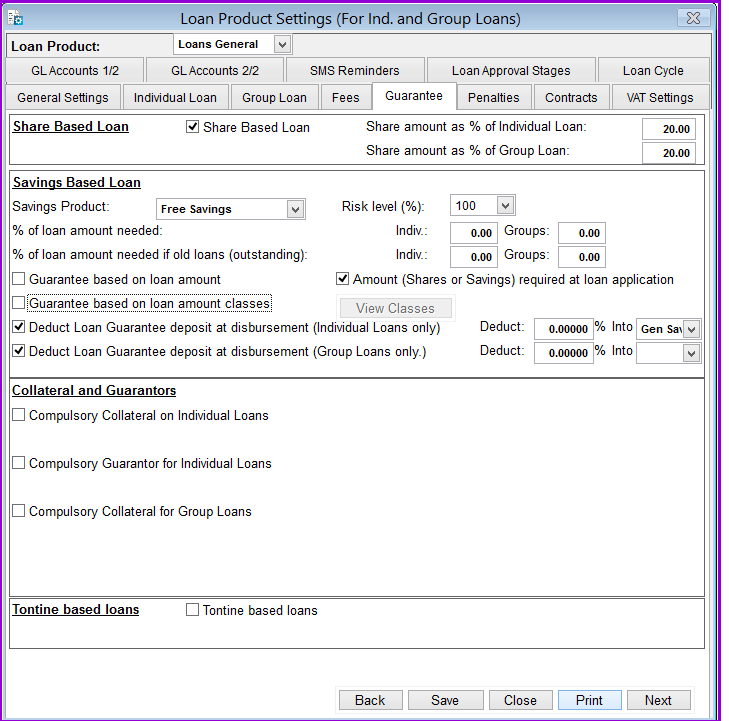

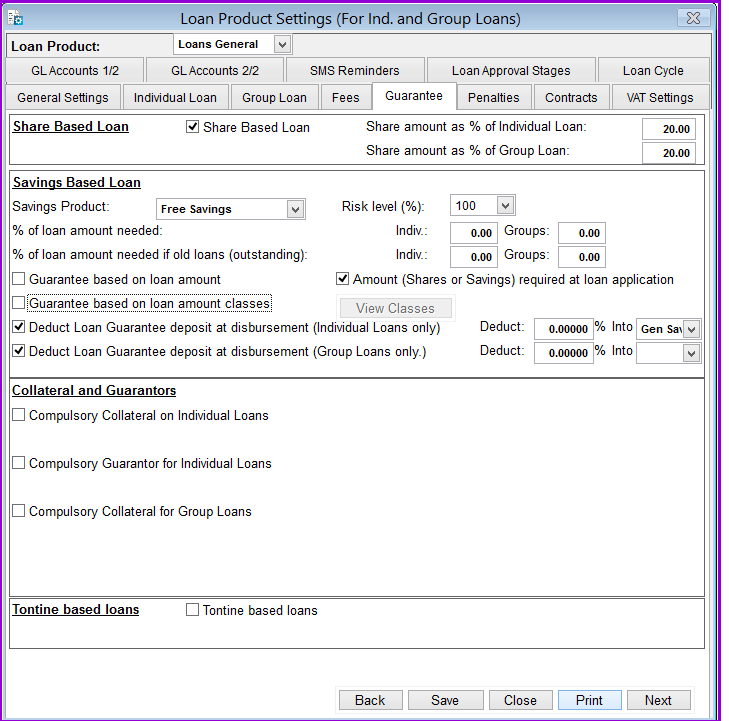

This tab enables you to define loan guarantee settings. These settings are defined per Loan Product. The loan products should be previously set at System/Configuration/Products.

How you define loan guarantee settings

To define loan guarantee settings, go to System/Configuration/Loan Product Settings/Guarantee, the following screen appears:

Shares Based Loans

Risk levels (%): These risk level percentages are essential when generating the Credit Risk Management report that is used by the Central Bank of Madagascar for interpretation and Credit analysis under the menu Central Risk Management.

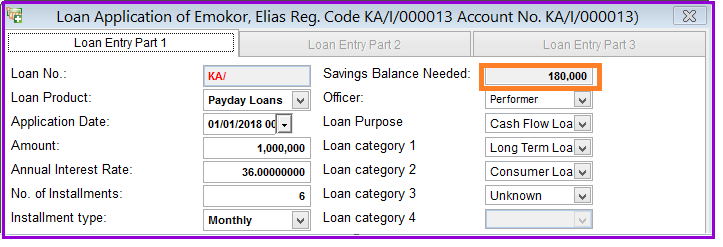

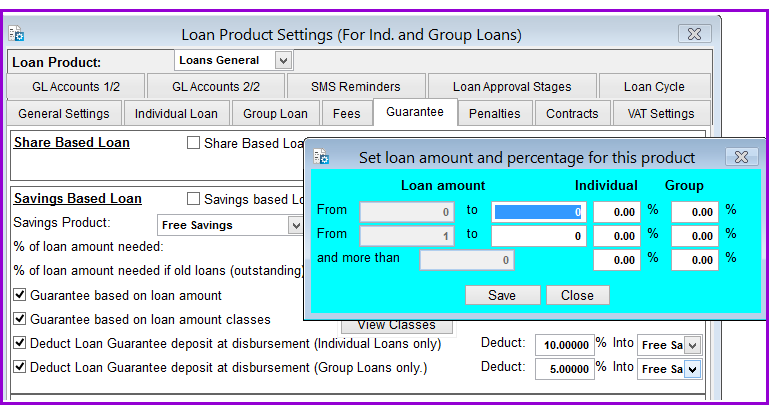

Savings Based Loans

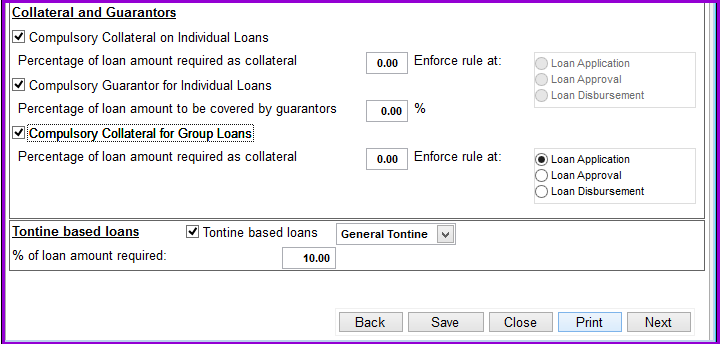

Collateral and Guarantors

Loan Performer gives you the option of making the guarantor or collateral requirements compulsory for groups or individuals, see the screen below:

Tontine based loans

Click on the Save button to save the settings and on the Close button to exit the menu.

The Nº 1 Software for Microfinance